Thursday, January 26, 2006

Understanding Our Industry

Tracking changes in magazine pages can help us under- stand what is happen- ing to the overall use of print. Ad pages are an important measure, because you don't need to adjust them for inflation.

For our industry, we're missing a part from the puzzle; circulation. This would give us implied run length. From other industry data, we know that circulation has been flat for 15 years. Recent postal data indicate that the total tons of periodicals mailed has been flat as well. All this has occurred at a time when the number of titles has been increasing.

But now to our data: for the 12 months of 2005, consumer magazine pages were up 1%. For 11 months of 2005, business publication pages were down -0.6%. Both of the organizations that report these data put the best face possible on the data, often reporting the dollar value of the pages. The consumer magazines data are based on "rate card" prices, similar to judging Wal-Mart's sales on retail list prices.

When compared to GDP, ad pages are clearly falling behind, an indication of a constantly changing media mix. While some are forecasting a crash in the magazine business, that doesn't seem quite likely to me. Publishers are still grappling with new formats and the creation of revenue streams from them. In the 1990s it was common to hear that "content is king." Yet you must eventually get to a bottom line: industries that cannot produce profits don't survive. That realization is causing incredible amounts of hand-wringing in the publishing business, and, of course, in ours.

In the long run, more low-circulation magazines seem to be an entrenched trend. This trend creates havoc with high-overhead, high- fixed cost publishing and printing infrastructures. Unraveling that structure is hard; organizations have an urge to protect legacy functions at great expense. Starting from scratch may actually be easier.

For our industry, we're missing a part from the puzzle; circulation. This would give us implied run length. From other industry data, we know that circulation has been flat for 15 years. Recent postal data indicate that the total tons of periodicals mailed has been flat as well. All this has occurred at a time when the number of titles has been increasing.

But now to our data: for the 12 months of 2005, consumer magazine pages were up 1%. For 11 months of 2005, business publication pages were down -0.6%. Both of the organizations that report these data put the best face possible on the data, often reporting the dollar value of the pages. The consumer magazines data are based on "rate card" prices, similar to judging Wal-Mart's sales on retail list prices.

When compared to GDP, ad pages are clearly falling behind, an indication of a constantly changing media mix. While some are forecasting a crash in the magazine business, that doesn't seem quite likely to me. Publishers are still grappling with new formats and the creation of revenue streams from them. In the 1990s it was common to hear that "content is king." Yet you must eventually get to a bottom line: industries that cannot produce profits don't survive. That realization is causing incredible amounts of hand-wringing in the publishing business, and, of course, in ours.

In the long run, more low-circulation magazines seem to be an entrenched trend. This trend creates havoc with high-overhead, high- fixed cost publishing and printing infrastructures. Unraveling that structure is hard; organizations have an urge to protect legacy functions at great expense. Starting from scratch may actually be easier.

Thursday, January 19, 2006

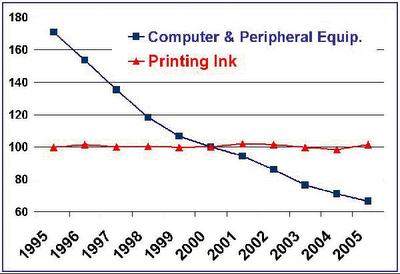

WHAT?? Printing Ink Now Linked to Computer & Peripheral Equipment?

Comparing the price changes in computer technology and printing ink may seem like a bit of a stretch, but it helps put some industry trends in perspective. The increasing use and decreasing costs of electronic media are putting significant pressure on the use of print. We've always maintained (and demonstrated, we hope!) that understanding the demand side of the communications business sheds light on what business conditions will be like for printers. Because of the declining costs of computer equipment, and also communications services (not shown here, but they are down), printing business owners are having trouble passing on their increased costs to print buyers.

The chart shows the producer price index changes for the costs of computers and peripheral equipment and printing ink. No one would have thought that these categories compete with each other, but we know in the "connected world," that they certainly do. The reasons for their price directions are quite different.

Computer equipment costs have continually dropped because the technology has been constantly improved, becoming more efficient, and less expensive.

Printing ink, while it has its own technological improvements, cannot match, nor can any hard goods commodity, the price declines of electronic technology.

As ink prices have remained essentially flat in a long-term perspective, so has paper, and so have the prices for which print is sold. Manufacturers have not been able to pass on their increased costs for raw materials, mainly because printers have no leeway to pass on their own increased costs to the ultimate buyers of printed materials.

Why? The costs of accessing electronic media keep going down because equipment costs keep going down. This has helped create a new media marketplace where consumers find that getting online and buying "gadgets" have great benefits to them, and, it seems, they want more. Other companies have faced this problem, where they can't create profits by selling price-sensitive goods. This is a primary reason why IBM made the strategic shift to services about a decade ago. Services, the selling of expertise that others cannot perform for themselves, has been an enormously profitable marketplace for IBM and others.Is printing a service or a manufacturing business? Changing strategy to become a service business is difficult, but worth it.

While printing can never shed its manufacturing core, what printing owners build around that core in terms of services is often the difference being a mediocre performer and being a great one. This is not the "value added" argument, which so often degenerates into a list of tasks that can be added to invoices or new equipment that should be bought. This is a major change in the strategy of the business. Our favorite strategy is the "communications logistics" business, where printers take their skills of handling complex workflows for print and use them in other media. We'll discuss this, and the other five strategies, in upcoming editions of PrintForecast Perspective.

Thursday, January 12, 2006

Are Imports to Blame for the Decline in U.S. Printing Shipments?

We've been asked this question quite a few times. Trade data are hard to interpret as to their real value because printing imports do not always bear the full cost to the customer. For example, they do not include the cost of delivery to the final customer, and if they were sold by a print broker, they do not have the value of that person's commissions and other factors.

Whatever the situation, it is quite clear that the shipments of imported printing are increasing. The biggest brunt of the increase may actually be Canadian printers, and not U.S. printers. It's interesting how the amount of the increase in printing from China is nearly identical to the decline in imports from Canada. Indeed, where for many years Canada had a printing trade surplus with the U.S., it now has a deficit.

Now's not the time to get into the issue of whether or not trade deficits matter (they really don't in the grander scheme), but it's more an issue of whether or not market shares are changing or whether the nature of the printing is changing. For all we've heard about being in an on-demand world, there are many print buyers willing to wait for weeks for their jobs to arrive from China.

It appears, by the way, that China's printing exports to the U.S. have doubled from the level found in 2004 to the levels indicated by the most recent 2005 data (January through November).

All in all, the U.S. trade deficit in printing is only about $180 million, or 0.2% of U.S. shipments. In effect, the U.S. balance of trade in printing is virtually zero. It's likely that will be changing in 2006.

The SFM Special Report "A Critical Look at Offshore Printing"

Whatever the situation, it is quite clear that the shipments of imported printing are increasing. The biggest brunt of the increase may actually be Canadian printers, and not U.S. printers. It's interesting how the amount of the increase in printing from China is nearly identical to the decline in imports from Canada. Indeed, where for many years Canada had a printing trade surplus with the U.S., it now has a deficit.

Now's not the time to get into the issue of whether or not trade deficits matter (they really don't in the grander scheme), but it's more an issue of whether or not market shares are changing or whether the nature of the printing is changing. For all we've heard about being in an on-demand world, there are many print buyers willing to wait for weeks for their jobs to arrive from China.

It appears, by the way, that China's printing exports to the U.S. have doubled from the level found in 2004 to the levels indicated by the most recent 2005 data (January through November).

All in all, the U.S. trade deficit in printing is only about $180 million, or 0.2% of U.S. shipments. In effect, the U.S. balance of trade in printing is virtually zero. It's likely that will be changing in 2006.

The SFM Special Report "A Critical Look at Offshore Printing"

Monday, January 09, 2006

Our Industry in Perspective

Despite the poor level of printing shipments for November (which is the next story), it is important to keep in perspective that ours is still a very large and important industry. I have made a short list of well- known U.S. manufacturing industries that are smaller than ours, yet often have a higher profile. The index calculates printing industry shipments equal to 100. This makes the comparison to others easy. If an industry is 50 in the chart, that means it's half our size.

Sure, there are industries that are bigger than ours, but we've got a long way to go before we disappear, which we're not, for quite a while. Don't mistake retrograde industry economics for a lack of opportunity.

U.S. Commerce Department Manufacturing Data